Before you start your Impact Journey, draw it

Running a for-profit business is difficult, but not particularly complicated. You want to acquire many customers, and you want to generate lots of revenue per customer. Of course figuring out *how* to do that is the hard part.

Let’s make a little doodle illustrating the journey of a company along the axes of # of customers and $/customer. Netflix might look something like this:

At various points in its history, Netflix has made plays to acquire more customers (eg., via international expansion) and to drive more revenue per customer (eg., via cracking down on shared accounts). All those decisions are in service of driving the business “up-and-to-the-right.”

At first glance, social impact orgs seem to share many of the same properties as for-profits. They want to maximize their impact via reach (# of people impacted) and efficacy (amount of impact per person).

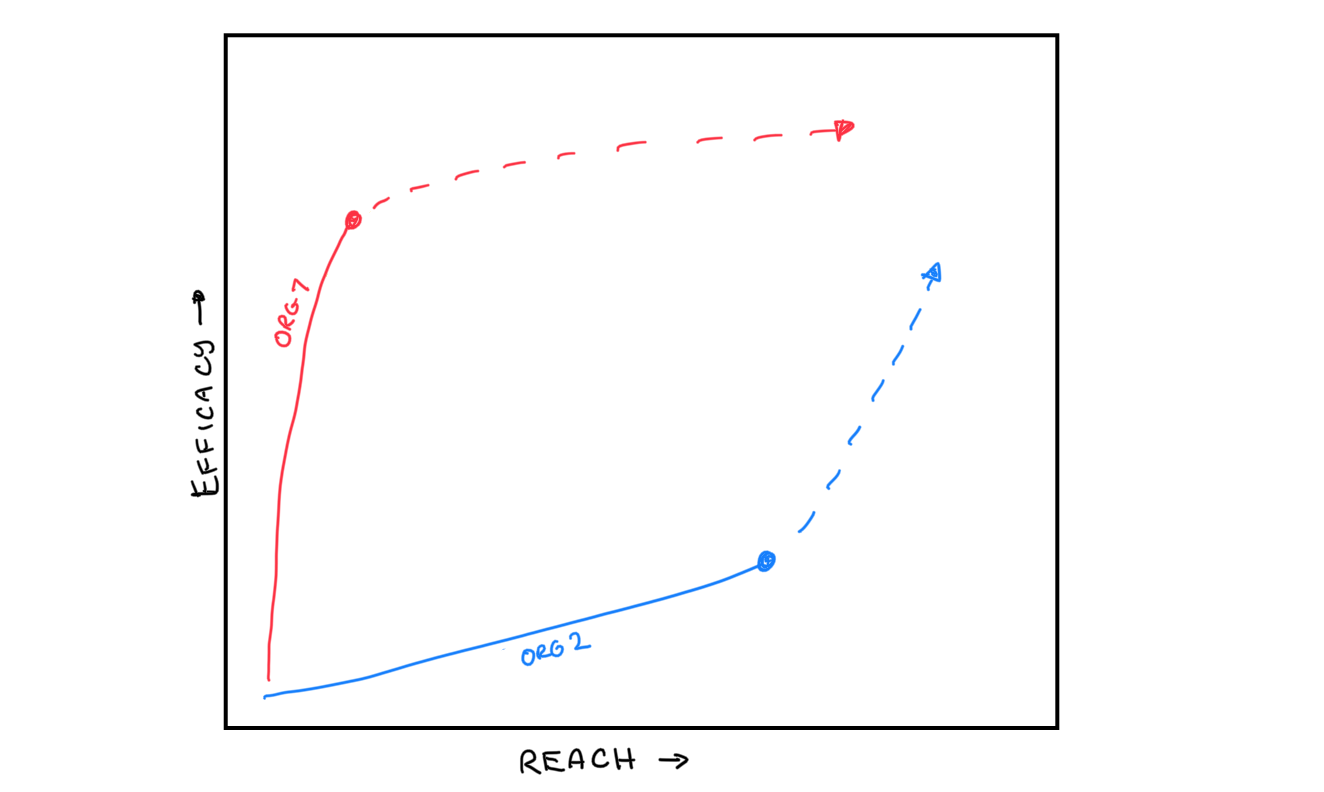

Let’s illustrate the impact journey of two social impact orgs:

Organization 1 chooses to carefully validate its efficacy in a controlled setting – perhaps a local pilot. At some point, Org 1 hopes that it will hit some efficacy target and then pursue impact at scale by reaching many more people – perhaps by rolling out a tech solution or hiring a sales team.

In contrast, Organization 2 chooses to reach many people, perhaps by solving a pain point or just by good marketing. At some point, Org 2 knows that it must actually demonstrate it’s effective – perhaps through instrumentation and a third party conducting research on it.

No approach is fundamentally better than the other – the right impact journey is context-specific.

But here’s the thing: Organization 1 is going to hit a “crunch” when it’s ready to scale. The funder who backed the small-scale pilot is almost certainly not the funder who will open the floodgates for wide reach. And there is no playbook for the handoff between those two stages.

This strikes me as a very different kind of crunch than the notorious “Series A crunch” that venture-backed startups face. That crunch loosens or tightens depending on economic conditions, and is a feature of the system, not a bug. Early-stage venture capital is organized around making many small bets with chances of huge payouts. To survive, startups must not merely be cash-flow positive, but must show some potential of “returning the fund” for the investor.

In contrast, the social impact crunch may be more of a regular-old bug. Possible avenues for debugging include: new models for early-stage philanthropy, which Nadia Asparouhova has explored in great depth (follow her at

); more opportunities for M&A within the social impact space; and increased awareness among founders about various funding mechanisms.In the meantime, it’s a very good idea for social impact founders to proactively design their Impact Journey early, ideally in partnership with prospective funders.